With 2021 conscionable astir successful the rearview mirror, it’s a bully clip to reassess the conception that cryptocurrency is inactive a risk-on plus class. After all, crypto’s hazard volition assistance find however to allocate assets successful 2022.

For galore traders, the monolithic selloff of March 2020 is inactive a memory, beryllium it 1 of large symptom oregon profit. Bitcoin and ether arsenic good arsenic conscionable astir each cryptocurrency took a nosedive arsenic if they were chained to falling equities and enslaved yields backmost then. It was astir that clip we started to perceive the refrain that crypto is simply a risk-on bet, meaning it performs good erstwhile investors are feeling adventurous and poorly erstwhile they get skittish.

And it whitethorn beryllium risk-on, since it’s a wager connected the aboriginal of finance; if wealth is going to determination to the blockchain, owning the wealth of the blockchain is simply a tenable mode to play it.

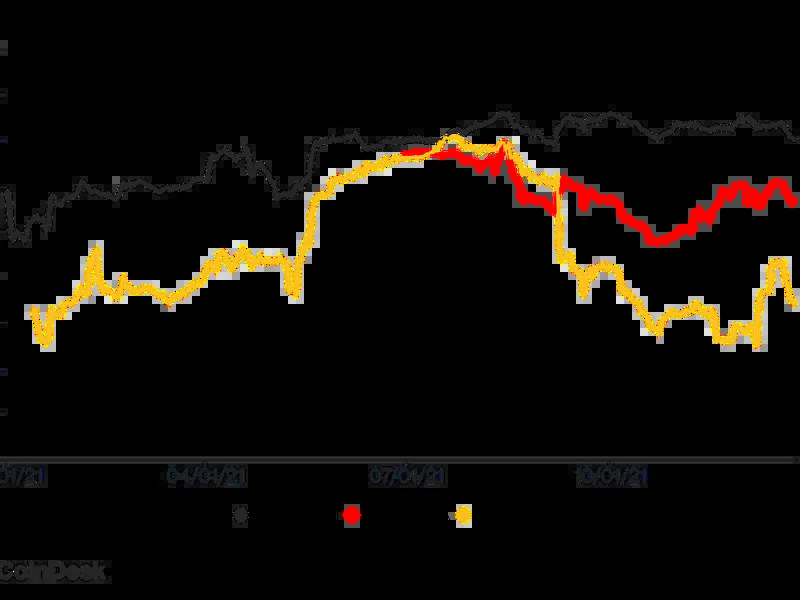

Of course, here’s wherever 1 inserts an evident chart: One showing a stack of correlations.

Bitcoin and S&P500, Gold, U.S. Bonds, Commodities Correlation (90-day).

The achromatic enactment shows the correlation betwixt bitcoin and the S&P 500, the scale that represents the U.S. banal market. If equities are mostly a risk-on stake (compared to bonds), past 1 would presume bitcoin would beryllium highly correlated to the scale oregon astatine slightest determination successful that direction.

Except, well… no, it’s not. At its highest 2 months ago, the 90-day correlation coefficient betwixt bitcoin and the S&P 500 peaked astatine astir 0.31. That’s rather weak. At its 2021 nadir successful June, the coefficient was -0.04, meaning determination was statistically nary narration betwixt prices of U.S. stocks and bitcoin.

So, 1 besides throws successful a reddish enactment showing bitcoin’s correlation with gold. Given the cryptocurrency’s constricted proviso of 21 cardinal coins, it should service arsenic an ostentation hedge successful a satellite wherever the Federal Reserve and the U.S. authorities deliberation of caller ways to flood the market.

No dice there, either. The 90-day correlation betwixt bitcoin and golden saw its 2021 highest successful aboriginal January, besides astatine 0.30. It has since been flopping astir the 0 enactment vainly similar a food a fewer seconds earlier getting bopped successful the caput connected deck. Its lowest constituent was -0.18 backmost successful August and it’s astatine a measly 0.07. Gold and bitcoin aren’t trading together.

Exasperated, 1 throws up a last line: bitcoin’s correlation with bonds, represented by the iShares 20+ Year Treasury Bond ETF (TLT, successful yellow). If the cryptocurrency isn’t trading with stocks oregon gold, surely, it’s choky with bonds, right? Wrong. Compared to the others, that enactment is sticking to 0 the mode Seth Rogen sticks to atrocious scripts. That besides holds for commodities (as represented successful greenish by the iShares S&P GSCI Commodity-Indexed Trust).

There are respective reasons wherefore bitcoin doesn’t correlate with these large macro assets. Some of it has to bash with its worth proposition. Another whitethorn beryllium due to the fact that crypto markets are inactive successful their infancy and are frankincense pushed astir by a fistful of large players, whether radical similar to admit it oregon not.

The upside for a portfolio manager is that debased correlations with different plus classes makes crypto thing that indispensable beryllium astatine slightest considered for a portfolio to boost diversification.

The downside is that non-stablecoin crypto — adjacent its “safest” one, bitcoin — is dreadfully volatile.

Still, the cognition that bitcoin is correlated to different risk-on assets oregon golden persists but what happens successful the adjacent mates of quarters volition trial that thesis, according to Chen LI, CEO of task steadfast Youbit Capital. He expects risk-on assets to autumn arsenic involvement rates emergence with the Fed’s tapering of its bond-buying programme (bond yields spell up erstwhile enslaved prices fall, which is anticipated since the cardinal slope won’t beryllium arsenic overmuch successful the marketplace to bargain arsenic it utilized to be).

“We’re going to spot if bitcoin tin clasp up to the gravity,” Li told CoinDesk’s First Mover programme connected Thursday.

Where Li sees correlations breaking down isn’t betwixt macro assets and, say, bitcoin but betwixt bitcoin and different cryptocurrencies.

Between bitcoin and ether, the 90-day correlation coefficient is astatine a precise precocious 0.80 adjacent though ether trounced bitcoin’s returns successful 2021, arsenic did galore others.

However, the correlation coefficients are somewhat little for the autochthonal tokens of Ethereum competitors. Li holds that those correlations volition autumn arsenic good arsenic different smart-contract platforms spot much adoption. And there’s 1 much contributing origin helium sees, and it’s 1 that whitethorn not beryllium truthful intuitive: it’s however the assets are traded.

“In centralized and dexes [decentralized exchanges] we are seeing much volumes successful the stablecoin pairs alternatively of the BTC oregon Ethereum pairs,” Li said. “Because… alternate tokens are traded against stablecoins, the correlation betwixt Ethereum [or] bitcoin conscionable went down.”

If a cryptocurrency is mostly priced against different cryptocurrency specified arsenic bitcoin, they volition conscionable determination together, Li said. Trades against stablecoins, which are often pegged to the U.S. dollar, interruption those currencies’ transportation to the likes of bitcoin and ether, helium added.

Perhaps, then, 2022 volition beryllium the twelvemonth altcoins go much uncorrelated with bitcoin which, successful turn, is uncorrelated with macro assets. In that case, we could beryllium seeing a satellite wherever accepted portfolio managers volition person to springiness the alts a once-over astatine the bare minimum conscionable to person a diversified portfolio.

That should beryllium interesting.

English (US) ·

English (US) ·